EXIUM

TEAM

INVESTMENT

TRACK RECORD

DAI FUND

DAI PORTFOLIO

CONTACT US

ES

Team

Partners:

Fernando Concha

Experiencia en Fondos de Deuda y Capital Privado, Gestión de Activos, y Compañías de Seguros.

CEO de un gestor de fondos de capital privado, firma especializada en la estructuración y levantamiento de vehículos de deuda.

Previamente, fue el COO de un fondo de capital privado en Colombia en donde cerró transacciones por USD 300 MM.

Antes de eso fue el CEO para América Latina en la aseguradora Royal S

Juan Carlos Paredes

Abogado con más de 18 años de experiencia en litigios e insolvencia.

Es fundador de Paredes López Asociados, firma en la cual ha asesorado clientes tales como Hocol y la Cámara de Comercio de Bogotá, entre otros.

Trabajó durante más de 9 años como abogado del área de litigios y reestructuraciones de Brigard & Urrutia Abogados.

Ha participado como inversionista, estructurador y asesor de compañías tales como Edospina, Grupo Areia, Agilitix, Conoobras y Sociedad Minera del Norte S.A.S., entre otras.

Alejandro Escallón

Experiencia en fondos de deuda, gestión de activos y banca de inversión.

Fundador de la banca de inversión Abaco Finance. En Abaco Finance ha cerrado 8 transacciones de deuda, capital y financiamiento exterior.

Previamente trabajó en el fondo de capital de deuda Ashmore-CAF, en donde realizó inversiones en deuda por COP 1.4 billones.

Antes de eso, trabajó en INVERLINK, una de las bancas de inversión líderes de la Región Andina.

Juan Carlos González

Experiencia en financiamiento comercial, factoring y financiamiento empresarial.

Fundador y CEO de Grupo Factoring de Occidente, logró una cartera de crédito en 2019 de COP 600.000 MM. El fondo de capital privado Kandeo realizó una inversión por el 50% de la compañía en 2016.

En 2019, Latam Trade Capital, líder regional en financiamiento de capital de trabajo, adquirió el 100% de la participación accionaria del Grupo Factoring de Occidente.

eXium Capital Partners is a team of specialists focused on corporate transformation. The founding team brings extensive experience and a proven track record in managing companies undergoing financial distress and special situations, as well as in private debt and risk management. eXium CP delivers innovative capital solutions that enable companies to restore balance and return to financial stability.

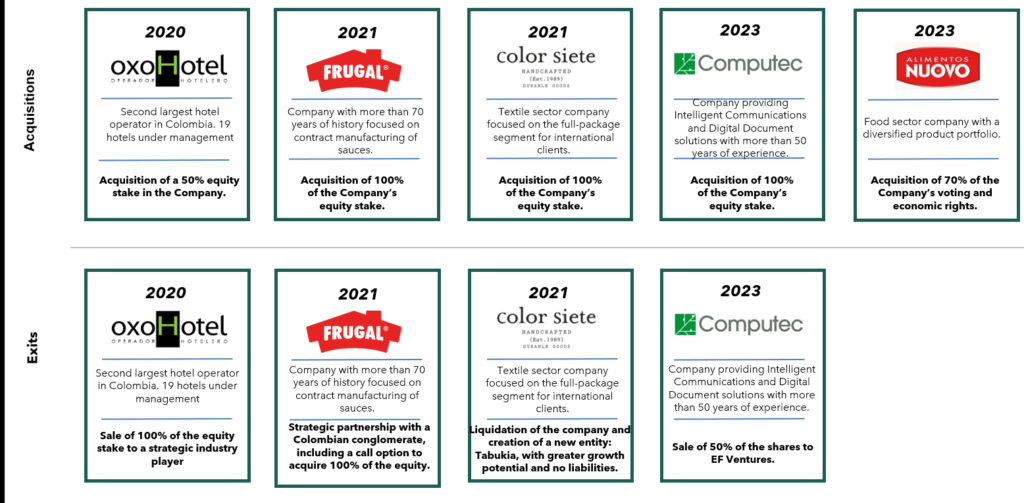

Since its inception, eXium CP has transformed companies across sectors including food, tourism, and textiles, among others, completing investments and exits in periods of less than 18 months.

eXium CP is a pioneer in the distress space in Colombia and the region for mid-sized companies, with the founding partners operating in this segment since 2008. Our young and dynamic team has significant experience in risk management, private equity, and private credit. Flexibility lies at the core of eXium CP’s strategy, providing tailored financial and operational transformation solutions adapted to the specific needs of each company.

Investment Thesis

eXium Capital Partners focuses on the acquisition of distressed companies.

The adverse situation faced by acquired companies may stem from over indebtedness, weak corporate governance, poor management, or disputes among shareholders. By acquiring these companies, value is created through commercial support, the restructuring of liabilities and obligations, and the design of a robust incentive package for the management team.

eXium’s team consistently focuses on companies facing short-term challenges rather than structural issues, identifying the key value drivers those variables where resources should be concentrated. We seek businesses with attractive gross margins and strong short-term turnaround potential.

Investment Process

Target Identification. Companies facing short-term challenges rather than structural issues.

Transaction Structuring. Acquisition through earn out arrangements with sellers or by assuming the company’s liabilities.

Management Incentive Plan Structuring. Design and implementation of incentive plans for the company’s management team.

Liability Restructuring. Restructuring of liabilities, including but not limited to proceedings under Law 1116.

Commercial and Strategic Support. Active support in the company’s commercial and strategic management.

Exit. Sale of the equity stake in the transformed and restructured company.

Track Record Exium

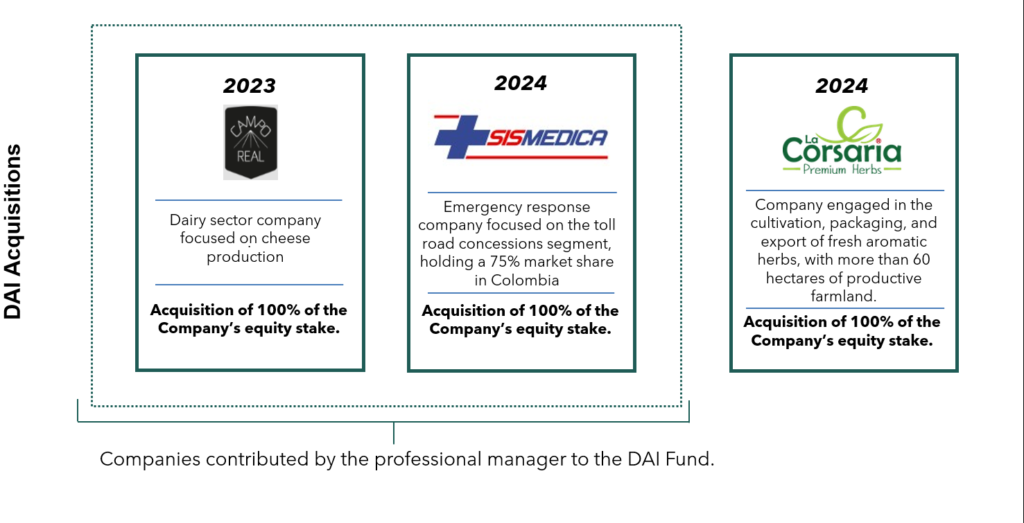

DAI is a regulated private equity fund backed by institutional investors and family offices. Our objective is to identify and transform companies with high growth potential by providing capital and strategic management.

The fund complies with applicable regulations and adopts market best practices for private equity funds in Colombia. Our structure is designed to ensure transparency, strength, and responsible management before regulatory authorities.

We currently have a team of experienced managers and specialized talent dedicated to transforming our portfolio companies. We have completed several strategic investments, each carefully selected, with growth and value-creation stories that reflect our investment thesis.

DAI Fund Portfolio Companies

Contact Us

Social Media

oportunidades@exium.com.co

Bogotá

Cra. 7 No. 84A -29

Office 403